Written to help you do a better job of managing your personal and family financial affairs and to help you get more for your money. You get ideas on saving, investing, cutting taxes, making major purchases, advancing your career, buying a home, paying for education, health care and travel, plus much, much more. Special issues cover the latest information about car buying (December) and Mutual Funds (March and September).

GET MORE ADVICE FROM KIPLINGER

Amazon Prime Fans

Retire Where You Want

Kiplinger’s Personal Finance

AN UPSIDE TO A DOWN MARKET • When the balance on a traditional IRA takes a major hit, consider converting it to a Roth.

Strategies for High Earners

CAREER ADVICE FOR NEW COLLEGE GRADS • Research potential employers, and don’t wear pajama bottoms for Zoom interviews.

CUT THE COSTS OF BACK-TO-SCHOOL SHOPPING • Sales tax holidays can apply to everything from laptops to shoes.

CALENDAR 08/2022

GET A HEAD START ON YOUR 2022 TAXES • INFORMATION ABOUT THE MARKETS AND YOUR MONEY.

SOCIAL SECURITY OUTLOOK: LESS DISMAL

WHERE AMERICANS ARE MOVING

MASTERS OF GROWTH INVESTING • The Baron Funds have an extraordinarily long and successful track record. Here’s how they do it.

BARON FUNDS WORTH BUYING

A Fund Legend Shares Stock-Picking Secrets

Our Dividend Picks Pay Off

Fight Inflation With Collectible • New platforms and fractional shares let ordinary investors add fine art, wine and more to their portfolios.

Stocks to Put on Your Watch List

These Dogs Are Best in Show

Should You Prefer Preferreds?

A Global Fund Hangs Tough

Data Drives This Fund’s Success • The managers use an algorithm to find solid stocks at bargain prices.

THE BEST BANK FOR YOU • We’ve identified the banks and credit unions that offer the best combination of high interest rates, low fees and a customer-friendly focus.

NATIONAL BANKS • These large, brick-and-mortar institutions have branches in several states (as well as online banking), so they’re solid choices if in-person assistance is important to you. They also have broad account offerings and investment and wealth-management services.

BEST FOR HIGH-NET-WORTH CLIENTS • Those who can meet high minimum-balance requirements at these banks get abundant account freebies and extras ranging from financial advice to event access.

BEST FOR RETIREES • With these institutions, retirees avoid pesky fees on checks and paper statements and have access to an array of additional wealth and investment services.

INTERNET BANKS • These institutions operate fully online, which decreases their overhead costs and allows them to offer lower fees and higher rates than many other banks.

BEST FOR FAMILIES WITH KIDS • Parents and children alike benefit from low fees and minimums on these accounts.

CREDIT UNIONS • Credit unions are not-for-profit institutions owned by their members. Those listed here are open to anyone in the U.S.; if you are not eligible based on geographic or employer affiliations, use the method listed in the “How to join” section to become a member.

SIGN-UP BONUSES, WITH A CATCH

How to Manage Your Student Loans • Proposals to forgive some student loan debt will still leave many borrowers owing money to Uncle Sam.

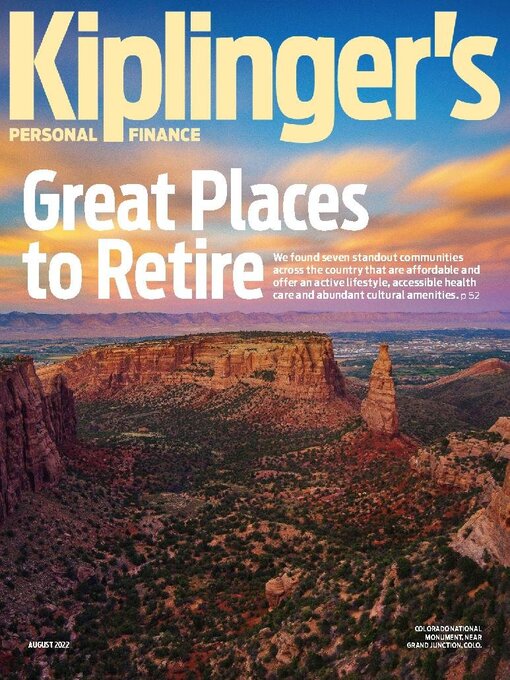

7 STANDOUT PLACES TO RETIRE • We picked cities across the U.S. that are affordable and offer the amenities retirees value most. Plus, one of them is bound to be close to family.

★ VISALIA, CA ★

★ GRAND JUNCTION, CO ★

★ TULSA, OK ★

★ FORT WAYNE, IN ★

★ WINSTON-SALEM, NC ★

★ SCRANTON, PA ★

★ MIDDLETOWN, CT ★

Don’t Wait to Start Downsizing

Dust Off Your...

Jan 01 2025

Jan 01 2025

Dec 01 2024

Dec 01 2024

Nov 01 2024

Nov 01 2024

Oct 01 2024

Oct 01 2024

Sep 01 2024

Sep 01 2024

Aug 01 2024

Aug 01 2024

July 2024 Double Issue

July 2024 Double Issue

Jun 01 2024

Jun 01 2024

May 01 2024

May 01 2024

Apr 01 2024

Apr 01 2024

Mar 01 2024

Mar 01 2024

Feb 01 2024

Feb 01 2024

Jan 01 2024

Jan 01 2024

Dec 01 2023

Dec 01 2023

Nov 01 2023

Nov 01 2023

Oct 01 2023

Oct 01 2023

Sep 01 2023

Sep 01 2023

Aug 01 2023

Aug 01 2023

Jul 01 2023

Jul 01 2023

Jun 01 2023

Jun 01 2023

May 01 2023

May 01 2023

Apr 01 2023

Apr 01 2023

Mar 01 2023

Mar 01 2023

Feb 01 2023

Feb 01 2023